A mentor, an inspiration – Robert Kiyosaki

In the vast landscape of financial education, there are few names as influential as Robert Kiyosaki. His groundbreaking book, “Rich Dad Poor Dad,” transformed the way I thought about money, wealth, and financial independence. But it wasn’t until I had the privilege of meeting him in person that the true impact of his wisdom hit home.

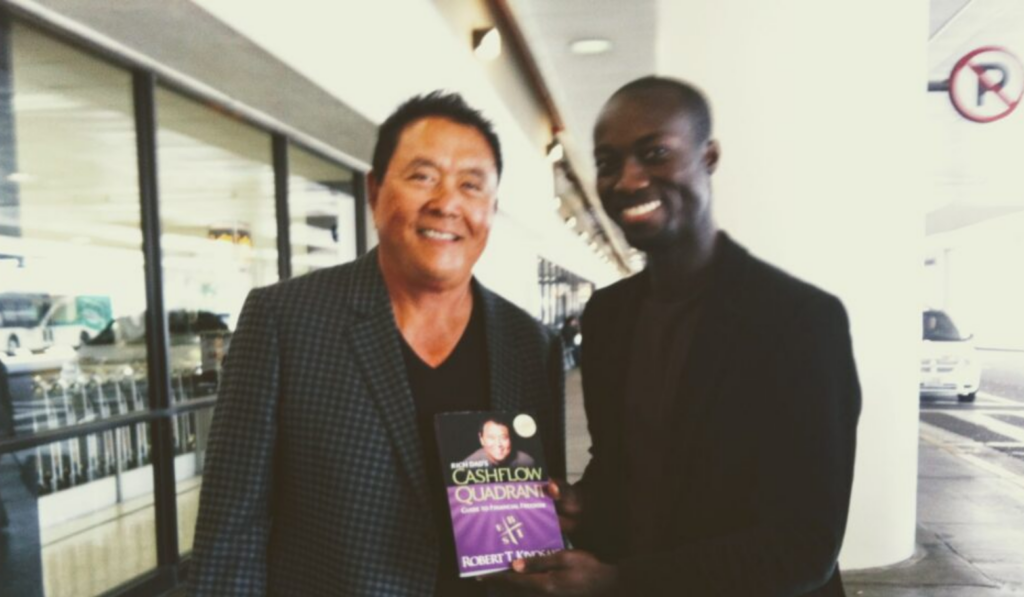

It was a crisp autumn morning when I found myself in a small conference room, surrounded by eager faces. The anticipation was palpable. Robert Kiyosaki, with his trademark grin and magnetic presence, stepped onto the stage. His words resonated with clarity and purpose, cutting through the noise of everyday life.

Key Lessons

1. The Cash Flow Quadrant

Robert introduced us to the Cash Flow Quadrant, a simple yet profound concept. He drew it on the whiteboard, dividing it into four sections:

Employee (E): Those who work for others.

- Self-Employed (S): Small business owners, freelancers, and professionals

- Business Owner (B): Entrepreneurs who build systems and teams.

- Investor (I): Those who make money work for them.

He emphasized that true financial freedom lies in transitioning from the left side (E and S) to the right side (B and I). It was an “aha” moment for me.

2. Assets vs. Liabilities

Robert’s voice echoed as he explained the difference between assets and liabilities. “An asset puts money in your pocket,” he said, “while a liability takes money out.” He urged us to focus on acquiring income-generating assets—real estate, stocks, businesses—instead of liabilities like fancy cars or oversized houses.

3. The Power of Leverage

“Use other people’s money,” Robert advised. Leverage is the secret sauce of wealth creation. Whether through real estate financing, business partnerships, or stock investments, smart leverage accelerates your journey to financial freedom.

4. Mindset Matters

Robert’s rich dad taught him that mindset shapes destiny. “The rich think differently,” he said. “They embrace risk, learn continuously, and surround themselves with experts.” I realized that my financial success depended not only on knowledge but also on my beliefs and attitudes.

Implementing Change

After that transformative encounter, I took action:

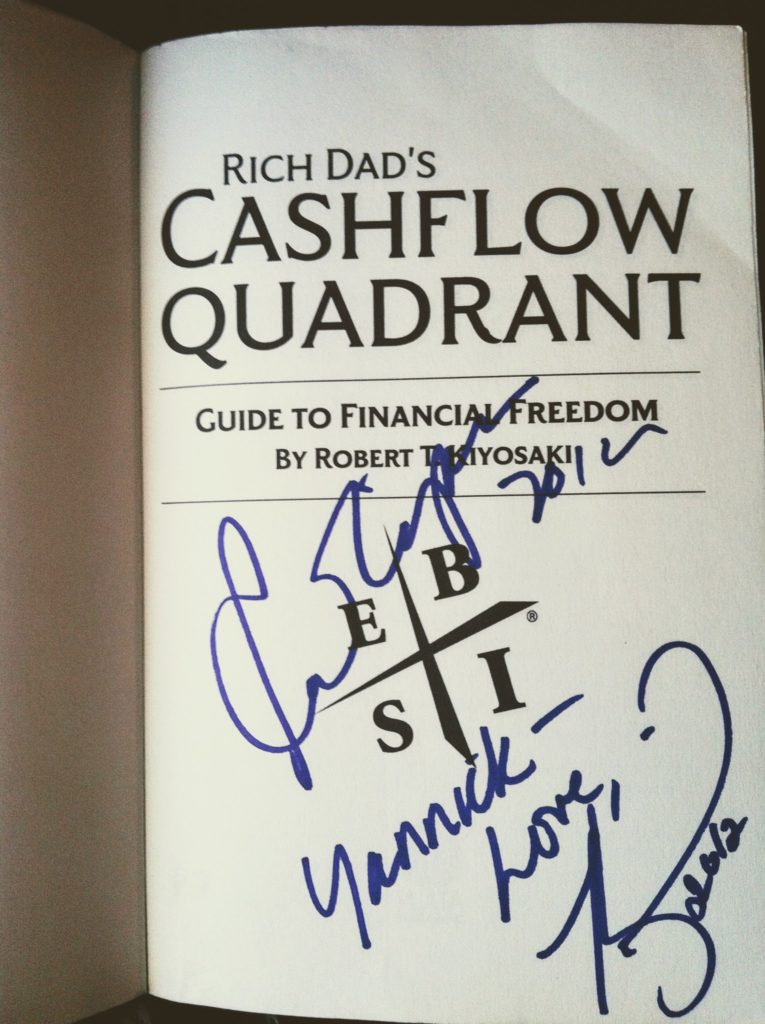

- Education: I devoured Robert’s books, attended seminars, and listened to his podcasts. Knowledge became my compass.

- Investments: I diversified into real estate, stocks, and small businesses. I learned to analyze deals and spot opportunities.

- Network: I sought mentors, joined investment clubs, and connected with like-minded individuals. The power of a supportive community cannot be overstated.

Meeting Robert Kiyosaki was a turning point. His teachings ignited a fire within me—a burning desire for financial freedom. Today, I stand on the right side of the Cash Flow Quadrant, building my wealth, one asset at a time. And as I reflect on that fateful encounter, I’m grateful for the mentorship that changed my life forever.

Remember, financial freedom isn’t a destination; it’s a journey. Embrace it, learn from the masters, and take deliberate steps toward your own financial independence

“Financial freedom is available to those who learn about it and work for it.”

-Robert Kiyosaki, Businessman